This is an easy one.

‘What does it mean to invest?’. To invest is to commit money (or resource) in order to gain a financial reward or future advantage. Some examples of investing are; buying property, purchasing stocks or reading a book. All of these actions require money or resource i.e. time and energy and are conducted for some form of future return such as owning a home, financial profit or extra knowledge. The problem is we all have limited resources and thus must be efficient in how we spend them. The aim is to extract the most value you possibly can out of every pound or minute invested. Whilst I fully believe everyone should invest as much as they can into their passions, family and friends… these topics are far too complex for me! As a result, I will focus purely on how one should invest for financial reward.

Financial investing is the process of making your money make you money, or ‘putting your money to work’. However doing this is not easy or simple. In reality investing for the future is risky, complex and demanding. The future is not certain and nothing is guaranteed – although over the long term asset prices (houses and stocks) do tend to rise, short term shocks like the 2008-2009 recession can and do happen. Investing is also complex and requires education in order to ensure correct decisions are being made by investors and that investments can be monitored and understood going forwards. Above all, investing requires courage. Making a decision to put all of your hard-earned savings into an investment outside of your control requires enough courage to trust in what you are doing and requires the discipline to not panic when things inevitably go through a bumpy patch. Investing is not smooth sailing. If it was… everybody would be doing it… and if everyone was doing it, it wouldn’t be worth it!

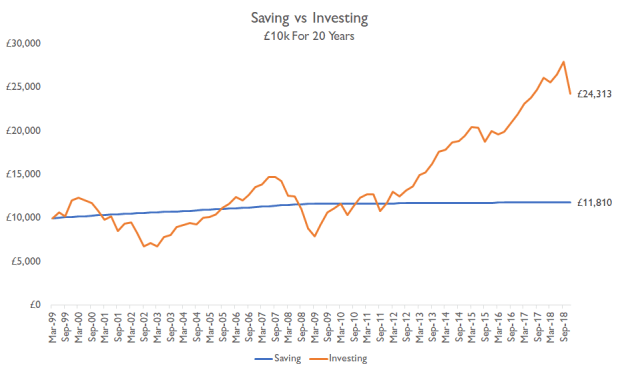

You might currently be thinking that financial investing sounds like too much effort, and that it probably is not worth it. Allow me to prove to you that it is! If you are not investing you likely doing either one of two things, spending all your earnings, or saving as much of them as you can. It is relatively simple to explain the issues with living paycheck to paycheck – you will not be able to cope well with unexpected expenditures, you will have to put your life on hold if you lose your job and lastly, you will have nothing to live off for retirement. Now lets assume your a saver, which is a very good thing to be, you may be fine when unexpected bills come by, or when your temporarily out of work, and if you have saved very well you may even survive retirement. An investor is someone who can do all of that, and then some. The chart below shows the difference between someone who kept £10,000 in a savings account over the last 20 years versus someone who invested the same amount over the same time period.

Investing would have made your same £10k worth over double the initial amount, and +£12k more than if it was kept in a savings account over the same time period. Now does investing seem worth it?

To conclude: Investing means to commit money (or resource) in order to gain a financial reward or future advantage, and one should invest because the rewards can be far greater than the alternatives over time.