So far in this ‘Portfolio Construction’ series we have introduced the idea of a portfolio, summarised how different assets classes behave and concluded that we are likely all owners of a multi-asset portfolio (Part 1). We then moved on to show how combining assets is beneficial to an investor by both increasing returns and reduce risk (Part 2). In this post we will talk through the underlying mechanics of how combining assets has a positive impact… correlation.

Lets start with some definitions and simple examples: Correlation – a relationship or connection between two or more things. Examples: sunny weather and ice cream sales, time slept and energy throughout the day. These examples both show positive correlation i.e. they both rise together. A negative correlation, when one thing goes up, the other goes down, is still a relationship and can be very strong one i.e. smoking and lung capacity, exercise and body fat (although some might not agree this has a strong correlation!). Finally, we also have a low/no correlation, mobile phone sales and rainfall… they will have no impact on one another. Correlations are measured mathematically on a scale of -1 to 1, 1 meaning a strong positive correlation, -1 a strong negative and 0 representing no correlation. You can see graphical examples of these below.

Illustrative Correlations with Trendline

Lets link all of this back to investing. When thinking about a portfolio, correlations are important because a portfolio of highly correlated assets would all do well together, or do poorly together. Most investors would rather have a smooth journey i.e. a portfolio that slowly climbs over time, than something that swings between making and losing you lots of money.

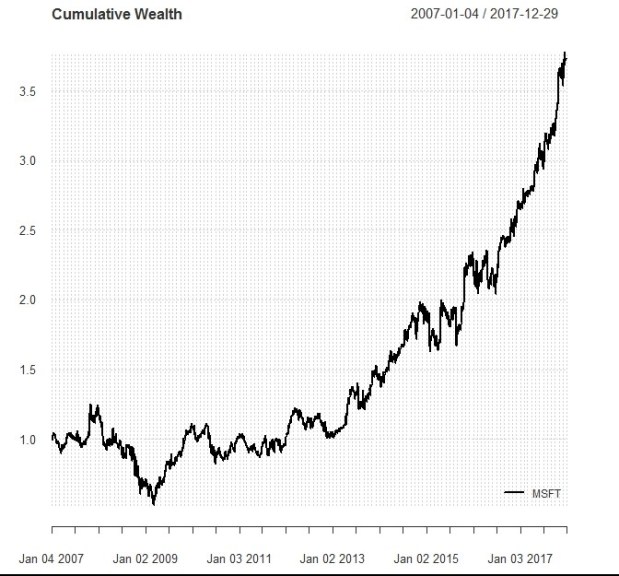

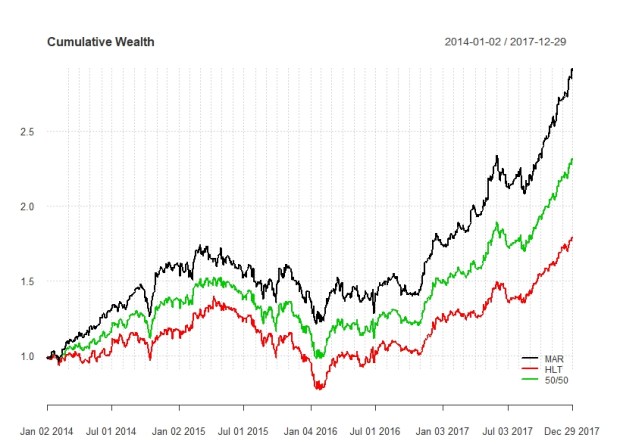

Imagine you had all your savings in Marriott and Hilton, two luxury hotel companies, your portfolio would have performed like the below…

Cumulative performance of Marriott, Hilton and a 50/50 portfolio

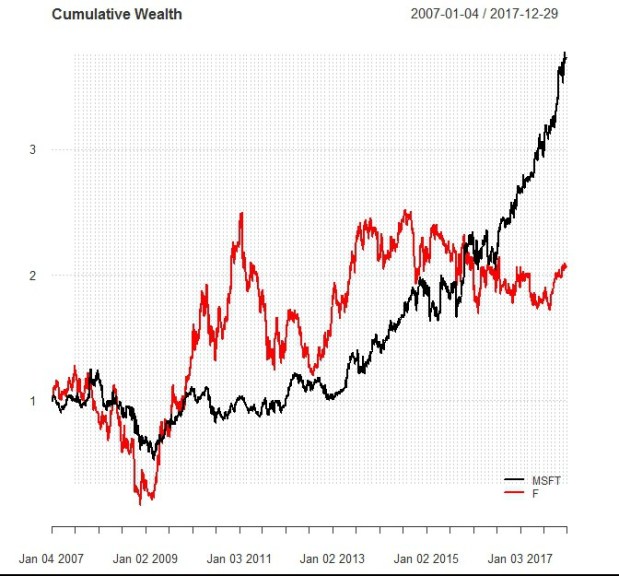

You can see from the chart that the pattern between the two companies returns is almost identical, when one of these stocks performs well, so does the other, when one performs badly so does the other. Combining these two stocks, offers little difference in the observable pattern. Contrast this to the example we looked at in Building a Portfolio which you can see again below.

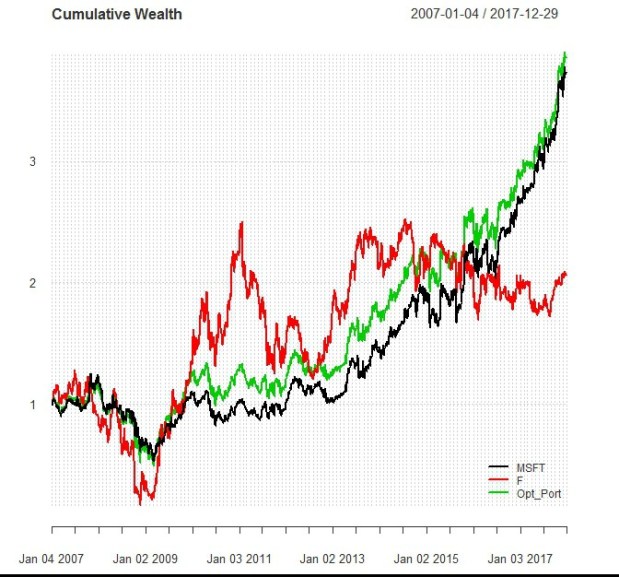

Cumulative performance of Microsoft, Ford and an Optimized Portfolio of both

As you can see, it is clear that the relationship between Marriott and Hilton is much closer than the relationship between Microsoft and Ford. This is reflected in the correlation numbers which are 0.73 and 0.4 for each pair, respectively.

By combining two things which are highly correlated you create a portfolio which is highly correlated to the original two things – the benefit of doing this is minimal. You can see by looking at the first chart you are better off having invested in just Marriott than buying Hilton or both. This is in contrast to Microsoft and Ford, where the combination was something different, and actually performed better than both the individual stocks. This was evidenced in the Sharpe Ratio which was 0.46 for Microsoft, 0.15 for Ford, and 0.49 for the combination. Marriott and Hilton have a Sharpe Ratio of 1.41 and 0.68 respectively. However when combining the two the Sharpe Ratio falls to 1.12 – lower than just holding Marriott.

OK… so why is this important to consider? When constructing a portfolio it is important for investors to consider their portfolio as a whole, and not each investment in isolation. If your best ideas happen to be 5 energy stocks… they might be great ideas on their own, and they might do very well for you… until the oil price crashes and they all come tumbling down at once. By looking at the correlation between the assets within a portfolio, investors can better avoid unknowingly putting all their eggs in one basket!